Which Country Will Outperform? Here’s Why It Shouldn’t Matter.

By Dimensional Asset Management

Investment opportunities exist all around the globe, but the randomness of global stock returns makes it exceedingly difficult to figure out which markets are likely to be outperformers. How should investors deal with this kind of uncertainty?

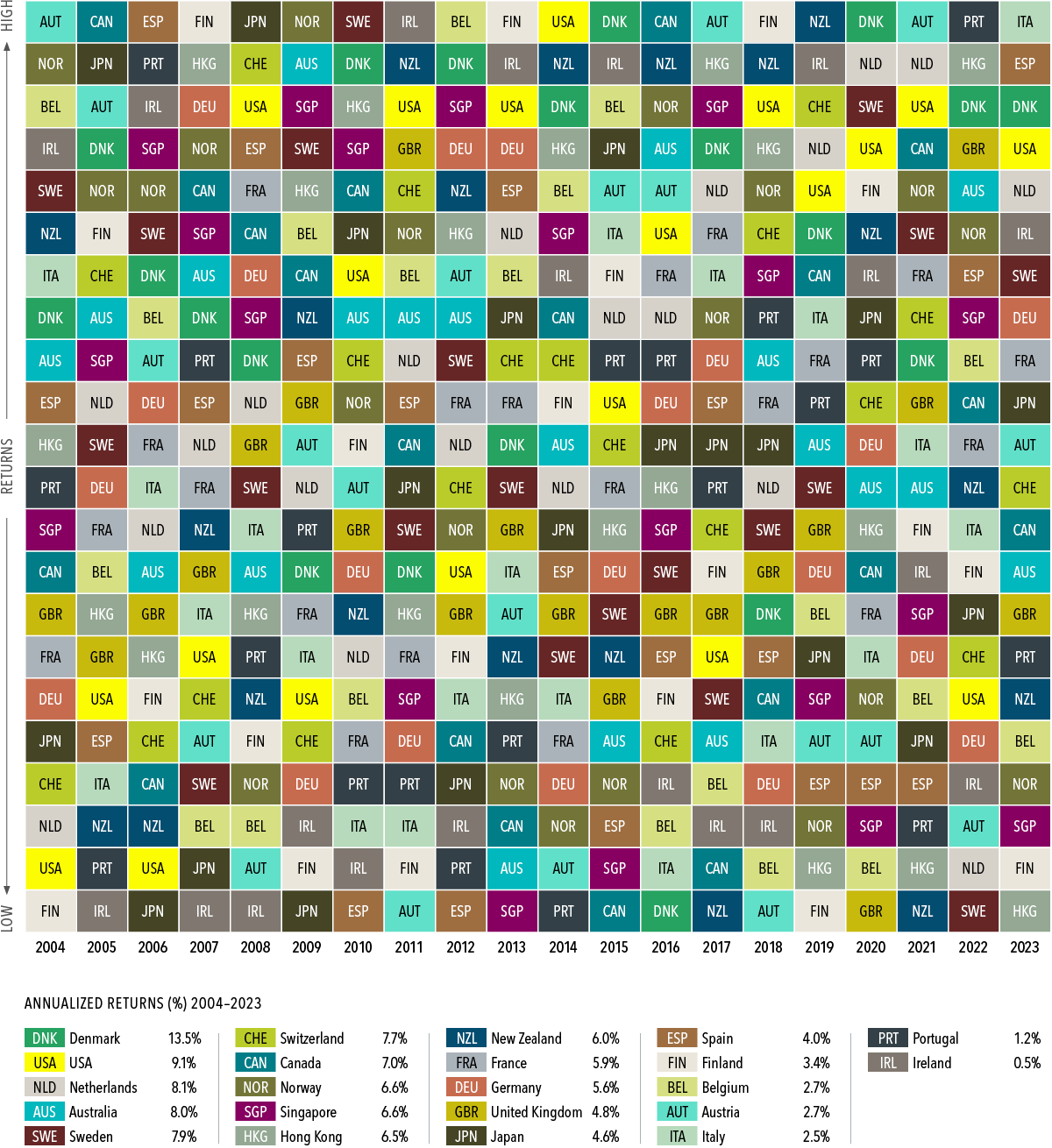

First, they should remember that it’s challenging, at best, to predict a country’s returns by looking at the past, as shown by the performance of global markets since 2004 (see Exhibit 1). In the past 20 years, annual returns in 22 developed markets varied widely from year to year. (Each color represents a different country, and each column is sorted top down, from the highest-performing country to the lowest.)

Most Favored Nations

Annual returns for developed markets, ranked (2004-2023)

A grid shows returns by country, high to low for the years 2004 to 2023. 2004:

Past performance is not a guarantee of future results.

Two examples help make the point well:

• New Zealand posted the highest developed markets return in 2019—but the lowest in 2021.

• The US ranked in the top two for annualized returns over the entire 20 years but finished first in the country rankings just once over that period. In eight calendar years, it was in the lower half of performers.

Investors can benefit from understanding that they don’t need to predict which countries will deliver the best returns during the next quarter, next year, or next five years. Why? Holding equities from markets around the world—as opposed to those of a few countries or just one—positions investors to potentially capture higher returns where they appear, and outperformance in one market can help offset lower returns elsewhere. Put another way, a globally diversified portfolio can help provide more reliable outcomes over time.