Market Update July 2024

By Mike Ross

By Mike Ross

Global Share Markets

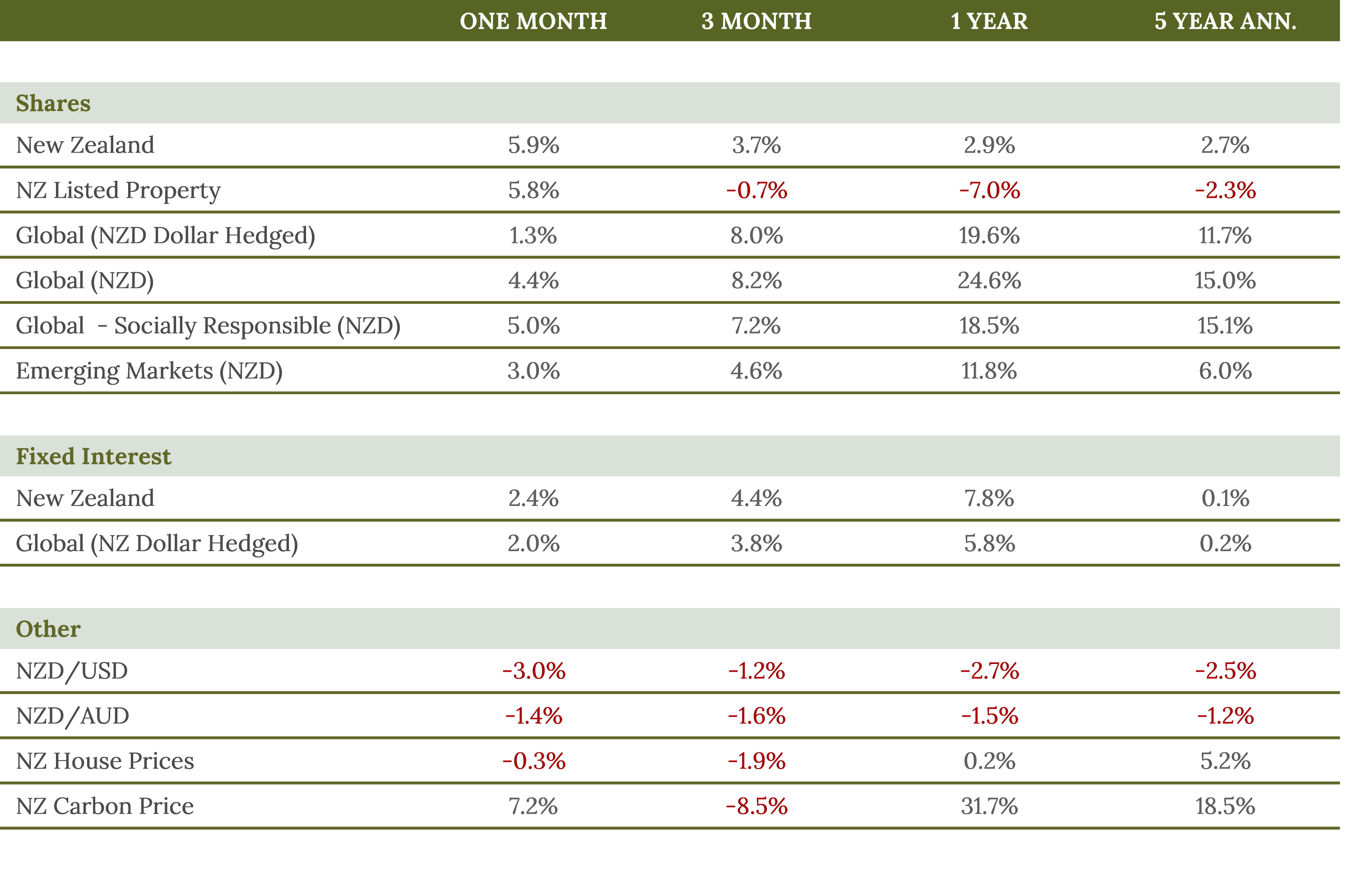

In July 2024, global financial markets saw increased volatility and notable shifts across various asset classes. Global shares returned 4.4% in New Zealand dollar-unhedged terms. However, the performance was more subdued when hedged to the New Zealand dollar, with a 1.3% gain. Small company stocks outperformed with a 6.9% rise, while growth stocks fell by 1.0% as investors became more cautious about future returns from artificial intelligence investments. Despite this pullback, growth stocks have still gained 16% year-to-date. Emerging markets also posted a solid 3.6% return, though performance varied across regions.

New Zealand Share Market

The New Zealand share market rebounded strongly in July after a lackluster June, returning 5.9%, and reflecting improved sentiment and attractive valuations. While the New Zealand economy appears to be in a recession, the prospect of (further) interest rate cuts from the Reserve Bank of New Zealand (RBNZ) has provided a boost to market confidence.

Bond Markets

July was a strong month for bond markets, which rallied on the back of expectations for interest rate cuts, both locally and abroad. NZ Bonds returned 2.3%, while global bonds returned 2.0%, and have now returned 7.8% and 5.8% respectively over the past year.